Malawi tax body collects K71.8 bn, beating October target by K7.8 bn

The Malawi Revenue Authority (MRA) has beaten the set revenue target for October 2016 by K7.8 billion, MRA Deputy Director of Corporate Affairs Steven Kapoloma has said.

Briefing news organisations at Msonkho House in Blantyre, Kapoloma said MRA has registered a total collection of K71.8 billion against a target of K64 billion.

“This represents a 12 percent surplus. For this fiscal year, from July to October, MRA has collected K251.8 billion which is against a projection of K228.5 billion, registering an excess collection of K23.3 billion,” said Kapoloma.

He said the four months collection represents an increase of 30 percent compared to the same period last year. The revenue collected for the four months in 2015/16 fiscal year was K193.58 billion

Kapoloma said this year’s remarkable performance for the four months is on account of the reforms championed by the Public Sector Reform Commission which MRA embraced coupled with enforcement measures, staff commitment and dedication to work.

“Notably Value Added Tax (VAT) collections have increased confirming that Electronic Fiscal Devices (EFDs) are also contributing a lot. The Authority therefore, calls on members of the public to take an active role in demanding fiscal receipts generated by EFDs every time they make a purchase. This will ensure that VAT is well account for,” he said.

The Authority stressed that sustained improvement in tax collection is a direct result of tax compliant behaviour by taxpayers who continue to voluntarily come forward to pay their taxes on time.

“Therefore, MRA is appealing to all taxpayers to be tax compliant as the 2016/17 fiscal year progresses. Timely payments of tax will enable the Malawi Government achieve its development goals, more especially now when there is limited external donor support.

“MRA is available at all times to the business community, NGOs and the public. Those who have taxation challenges should engage us so that their tax affairs are regularised for the continued growth and development of our beloved country, Malawi,” Kapoloma said.

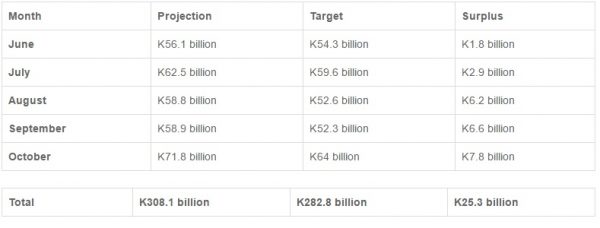

- The October 2016 collection follows back-to-back positive performances by MRA from June, 2016 as indicated below:

This is not an achievement to be proud of. The MRA is taxing a thin cow thinner and thinner. Meanwhile Nigerians and Amwenye (Indians or Pakistanis?) continue to evade duties. Ministers continue to import everything duty free. As much as taxes are beneficial to our country, it is so distressing when Nigerians and Amwenye and ministers evade taxes. Amalawi, tilira, nanji ukunso kulowa Trump (January 2017) who does not pay taxes.

Yes we have seen the figures but what does it mean to Malawians?Is it reviewing MRA performance or you are telling us that you doing well and the problem is implementers.Since we entered new fiscal year there ia nothing tangible that department can show.What has remained in Malawi now is talking to so that the mass believe that something is happening–empty cosmetic talks.That,s the art of lairs and failures.